The social security system in France

(Please note that information may change depending on the regulations in force when you arrive in France.)

In this section you will find information about:

- The French social protection system

- Affiliation to the CPAM (Primary Health Insurance Fund)

- How to get a carte Vitale – the French health insurance card

- How to contact your health insurance fund (CPAM)

- Doctors and pharmacies

- Additional health insurance aka « MUTUELLE »

- Civil liability insurance aka third party liability cover

- Professional liability insurance

- Emergency telephone numbers

The French social protection system

The social security system in France is known in French as la Sécurité sociale or la Sécu. The health insurance branch of the Sécurité sociale is called Assurance maladie.

It is mandatory for all residents in France to have health insurance covering all or part of their health costs.

France’s universal health care system (PUMa) guarantees coverage of healthcare expenses for all individuals who exercise a professional activity or have been residing in France on a stable and ongoing basis for at least 3 months.

The French health insurance system covers reimbursement of healthcare costs for insurees and their minor dependents who are their beneficiaries (« ayant droits »).

The social security system in France is publicly funded by taxation and through social security contributions made by employees and employers.

On average the basic health Insurance provided by the French social security system reimburses 70% of medical expenses (medical visits, medication and surgical procedures). It is therefore advisable to take out an additional health insurance, called a mutuelle to top up the reimbursements of medical expenses for example for glasses or dental care.

Each affiliated member of the French Social security system has their own social security number. Since January 2016, adults can no longer be considered beneficiaries even if they are not in employment. Only minors can be beneficiaries up to September 30th of the year in which they turn 18 provided that they are not employed.

Registration to the French social security system is free and mandatory for all students in France, whatever their age.

The French social security system is basically a number of statutory schemes:

- The compulsory general scheme which covers most employees and certain other categories (students, beneficiaries of certain benefits that have progressively come under the general scheme).

- Various "specific" schemes covering categories such as farming and special schemes which cover civil servants, military personnel and other workers from the public sector such as SNCF, EDF-GDF etc …

For more information, please consult the website of the CLEISS (Centre of European and International Liaisons for Social Security), in particular the webpages dedicated to sickness insurance and accidents-at-work and occupational-diseases branch.

Affiliation to the CPAM (Primary Health Insurance Fund)

To register for membership in the French social security system, you need to submit an application to the CPAM (Caisse Primaire d'Assurance Maladie) – the health insurance fund.

The procedures vary depending on your personal and professionalstatus and on your country of origin.

Access to care

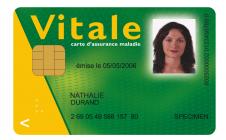

The Carte vitale is a card with an embedded microchip that certifies entitlement to Assurance maladie (French health insurance).

Once your application process has been completed by CPAM, you will receive a unique permanent 15-digit social security number and a form to apply for a Carte vitale. You have two options :

- either fill out the paper form, attach a photo and send back to your CPAM to request your Carte vitale

- or open an ameliaccount and wait for your temporary access code to come in the post. Once you have access to your account, you can upload a photo for the card and request it directly in the portal.

If you need any information, regarding your social security insurance, benefits and healthcare rights in France, you can call the bilingual French Health Insurance Advice Line :

0 811 36 36 46 (from France*)

0033 811 36 36 46 (from other countries)

Monday to Friday, from 8:30 a.m. to 5:30 p.m.

For maximum reimbursement by Assurance maladie you must choose and declare a primary care physician (médecin traitant). To inform your health insurance fund of your choice of primary care physician, you must complete a declaration form that can be downloaded here. This document must be signed by your chosen medical practioner and submitted to your CPAM.

General practioners can be consulted for any health issue. If you have a specific health problem and need to be seen by a specialist doctor, you must asked your chosen medical practioner to write a referral so that you can be seen by a medical specialist.

Dentists, ophtalmologists and gynaecologists can be consulted without a referral.

- Medication : Only medicine prescribed by a medical practioner and bought in a pharmacy is reimbursed. The reimbursement rate varies according to the nature of the medicine. The rate of reimbursement for prescriptions varies between 15% to 100% depending on the type of medicine.

When you subscribe to the Universal Health Cover in France, the basic health insurance will only reimburse a proportion of your healthcare costs - approximately 70%. Additional health insurance covers healthcare expenses that are not covered by the basic health insurance scheme. For this reason, it is highly recommended to take out supplementary health insurance – a mutuelle- that will cover all or a proportion of your healthcare costs that are not reimbursed (the remaining 30%).

In some cases, a mutuelle also reimburses the costs of medical or paramedical services not covered by the French social security (osteopathy, dental implants, non-refundable medication, elective surgery procedures, etc …).

In France there are many additional health insurance policies that offer different levels of cover that can vary depending on your requirements. Therefore, it is a good idea to compare offers to work out supplementary health insurance has the best plan for the specific healthcare needs of you and your household. To compare private health insurance providers you can use a price-comparison website such as https://comparateurs.mutuelle-conseil.com

Subsidised Supplementary Health Insurance (CSSComplémentaire Santé Solidarité) is awarded free of charge to people whose income is very low and who have been residing in France for more than 3 months. People who are entitled to CSS receive free 100%coverage for their medical expenses. In order to be eligible, your income must be below a threshold. Application is made on behalf of the whole household, not on an individual basis.

To check if you are eligible for CSS visit the following site :www.ameli.fr/simulateur-droits

If you believe you are eligible for CSS, fill in cerfa form n°12504*08

Civil liability (laResponsabilité Civile) is the obligation to compensate damages (physical, material and immaterial) caused unintentionally to other people. To be taken into account by the insurance company, the damages caused must be due to your negligence or imprudence. Third-party civil liability is obligatory and is usually included in house insurance or car insurance policies.

Civil liability does not cover intentional damages, damges caused in a professional environment, damage done to oneself or to close relatives, damages caused by dogs considered as dangerous, damages caused by a motor vehicle,

Civil liability insurance is compulsory for anyone living in France. For the first 3 months it may be included in the travel insurance signed before arrival in France. After 3 months of residence in France, it is compulsory to have a civil liability insurance with an insurance provider in France.

You can subscribe to a civil liability insurance from an insurer, a mutual fund or a bank. When you subscribe to a civil liability cover, check who is covered, any excess that you will still have to pay and the limits of the cover provided (exclusion clauses, upper limits, etc …).

If you have a French employment contract, you are covered by your employer’s ATMP (Accident du Travail – Maladie Professionnelle) insurance.

In the absence of a French employment contract or of a specific agreement regarding insurance cover whilst doing research work within the host research establishment, you may take out a professional liability insurance - Responsabilité civile professionnelle - which will cover costs for material or physical damage to a third party occurred during your research stay.

Professional liability insurance can sometimes be added to a travel insurance package subscribed in your country of residence before coming to France. It is also possible to take out professional liability insurance with an insurer in France.

The emergency numbers allow you to reach the emergency services 24 hours a day free of charge. Be sure to specify the following 3 points:

- Who am I? victim, witness, etc., give a phone number to stay reachable.

- Where am I? give the precise address of the place where the services must intervene.

- Why am I calling? Specify the reasons for your call.

European emergency number: 112 (emergency centre closest to the call point)

SAMU: 15 (medical emergencies)

Firefighters: 18 (serious emergencies)

Emergency number dedicated to deaf and hard of hearing people: 114

Free European number for missing children: 116000

SAMU social: 115 (emergencies concerning homeless people - 7 days a week from 9 a.m. to 11 p.m.)

Allo abused childhood: 119

Pharmacies on duty: 3237 or http://www.3237.fr/